Introduction

The Centrica share price has been closely monitored by investors seeking stable opportunities in the UK energy sector. As one of the country’s leading energy companies, Centrica is responsible for electricity and gas supply, alongside services such as British Gas. Its stock performance is influenced by a combination of market volatility, regulatory changes, and strategic business decisions. Understanding these factors is crucial for anyone considering investing in Centrica, whether for long-term growth or short-term gains.

In this guide, we delve into Centrica’s historical share price performance, explore factors affecting its stock, and provide insights into future trends. We’ll also cover investment strategies, dividend potential, and compare Centrica with competitors in the energy market. By the end, you’ll have a comprehensive understanding of the Centrica share price and actionable information to make informed investment decisions in 2025.

What Is Centrica and Why It Matters to Investors

Centrica plc, headquartered in Windsor, UK, is a multinational energy and services company with operations across the globe. Known for British Gas, its largest subsidiary, Centrica provides electricity and gas to millions of households and businesses.

Investors closely watch Centrica because of its unique positioning in a sector that is both essential and subject to frequent regulatory scrutiny. The company’s performance directly impacts its share price, as revenue from energy supply and service contracts constitutes the bulk of its income.

Centrica’s strategic moves—such as investing in renewable energy, expanding services, and digital innovations—also influence investor confidence. Compared to competitors like SSE, EDF, and National Grid, Centrica offers a combination of stable dividend payments and growth potential, making it an attractive option for both conservative and growth-oriented investors.

Historical Performance of Centrica Share Price

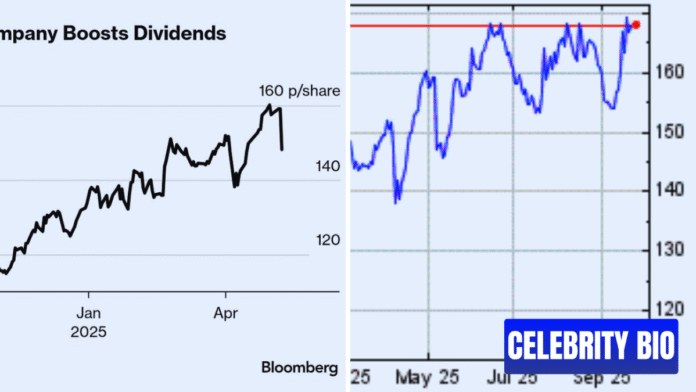

Over the last decade, the Centrica share price has experienced fluctuations driven by global energy crises, domestic regulatory changes, and company-specific events. In 2014, Centrica reached a peak of around 270p per share, fueled by strong earnings and stable gas supply contracts. However, following volatility in energy markets and declining profit margins, the share price dropped significantly in subsequent years, reaching lows near 100p in 2020.

Market analysts note that such fluctuations are typical in the energy sector, where global oil and gas prices, geopolitical tensions, and weather-related demand spikes can dramatically impact stock value. Compared to the FTSE 100 index, Centrica’s share price has shown more volatility but also periods of strong recovery, reflecting the sector’s sensitivity to external factors.

Factors Influencing Centrica Share Price

Energy Market Volatility

The price of oil, gas, and electricity directly impacts Centrica’s profitability. Sudden increases in wholesale energy costs can strain margins, while reductions can enhance profitability.

Regulatory Impact

Government policies, subsidies for renewables, and carbon taxes play a pivotal role. For example, the UK’s energy price cap and sustainability incentives can affect Centrica’s revenue streams.

Company Performance

Revenue, profit margins, and acquisitions influence investor sentiment. Strategic decisions, such as Centrica’s investments in smart meters and renewable energy, can drive stock price growth.

Investor Sentiment

Analyst ratings, market speculation, and institutional investments shape trading trends. Positive news about earnings or expansion often leads to share price rallies, while operational setbacks or regulatory hurdles can trigger declines.

Centrica Share Price Forecast for 2025

Financial analysts project a cautious yet optimistic outlook for Centrica in 2025. With global energy demand rising and renewable initiatives gaining traction, Centrica could benefit from a transition to cleaner energy sources.

- Optimistic Scenario: Prices could rise above 150p if regulatory incentives and efficiency improvements continue.

- Moderate Scenario: Share price may stabilise around 120–130p amid market volatility.

- Pessimistic Scenario: A global energy crisis or regulatory challenges could see the price dip below 100p.

Investors should monitor energy market trends, government policies, and Centrica’s strategic moves to gauge the stock’s trajectory accurately.

Dividends and Returns: What Investors Should Know

Centrica has a history of paying regular dividends, providing a steady income stream for shareholders. Dividend yields historically range between 3% and 6%, offering a balance between growth and income.

Investors should consider the payout ratio, which reflects the proportion of earnings returned as dividends. Centrica’s stable dividend history enhances its appeal to long-term investors seeking consistent returns. When compared with peers such as SSE and EDF, Centrica offers competitive yields, although its share price volatility can influence overall returns.

How to Buy Centrica Shares

Purchasing Centrica shares is straightforward for UK investors. Shares are traded on the London Stock Exchange (LSE), and investors can use brokers or online trading platforms such as Hargreaves Lansdown, AJ Bell, or Interactive Investor.

Steps to Buy Shares:

- Open a brokerage account (ISA or SIPP for tax advantages).

- Deposit funds into your account.

- Search for “Centrica plc” or ticker “CNA.”

- Place a buy order at market or limit price.

- Monitor your investment regularly.

Investors should be aware of fees, taxes, and risks associated with stock trading. Diversifying investments helps mitigate potential losses from market volatility.

Investment Strategies for Centrica Shares

- Long-term Holding: Benefits from dividend income and potential capital appreciation. Suitable for risk-averse investors.

- Short-term Trading: Capitalises on price fluctuations. Requires active monitoring and market knowledge.

- Diversification: Combining Centrica with other energy stocks and sectors reduces exposure to single-market risks.

Risk management is essential. Using stop-loss orders and setting clear investment goals can protect against sudden market downturns.

Centrica vs Competitors: Who Leads the Market?

Centrica faces competition from SSE, EDF, and National Grid. While SSE focuses heavily on renewable energy, Centrica maintains a balance between traditional energy and services. National Grid has a strong transmission focus, limiting direct competition.

Key differentiators for Centrica include:

- Established customer base via British Gas

- Stable dividend policy

- Strategic investments in renewable energy and digital services

Investors should weigh market share, growth potential, and dividend stability when comparing these companies.

Risks and Challenges Facing Centrica

- Energy Price Volatility: Sudden swings in gas and electricity prices.

- Regulatory Pressures: UK and EU energy policies may limit profitability.

- Operational Risks: Infrastructure issues and maintenance costs.

- Competition: Rising renewable energy startups challenge market share.

Risk mitigation involves diversification, staying informed about policy changes, and tracking market trends.

FAQs About Centrica Share Price

What is the current Centrica share price?

Prices fluctuate daily; check the LSE or financial apps for live updates.

Does Centrica pay dividends?

Yes, with historical yields between 3% and 6%.

Is Centrica a good long-term investment?

Offers stable dividends and moderate growth; subject to energy market volatility.

How can I buy Centrica shares?

Through LSE-listed brokers and trading platforms.

What factors affect Centrica share price?

Energy markets, regulatory changes, company performance, and investor sentiment.

Key Takeaways

- Centrica offers a blend of growth potential and stable dividends.

- Share price influenced by energy markets, regulations, and company performance.

- Investment strategies vary from long-term holding to active trading.

- Staying informed on market trends and forecasts is essential for investors.

Conclusion

The Centrica share price presents both opportunities and challenges. By understanding market dynamics, company strategies, and global energy trends, investors can make informed decisions. Whether seeking dividends or capital growth, Centrica remains a central player in the UK energy sector.

Share this guide, comment with your investment insights, and stay updated with Centrica’s market movements in 2025.